Portfolio Rebalance / April 10

Following the Signal Sigma Process

The approach to this article follows the step by step process described here. All visuals are sourced from various instruments available in the platform. If you are using the Portfolio Tracker, you’ll be able to see how we set it up for our own portfolio at the end of this article.

This morning’s inflation data has the market on the back foot, as the March CPI report came in hotter than expected. Year on year inflation was reported at 3.5% (vs expectations of 3.4%) and Core Inflation was 3.8% (vs expectations of 3.7%). The differential is not that large, but investors will probably take any reason to sell at this point. We would not read too much into this data point, as inflation has already had a couple of “bumps” in the past year and has ultimately gone lower. However, we will concede that this data is not encouraging for Fed rate cuts in the near future, and the action in the treasury market is reflecting that, with yields spiking. Higher yields are problematic for a variety of asset classes, especially economically sensitive small caps.

Asset Class Allocation

The first step in determining optimal portfolio positioning is taking a look at the performance of the main asset classes, and determining which are suitable for investment. The Asset Class Overview Instrument gives us a clear macro picture.

Stocks, bonds and commodities are investible, while Gold is registering a very high deviation, but has not yet pulled back;

SPY appears to be breaking critical support at the 20-DMA, as of this writing. The next logical support level for the market is $496 (R1, -4.49%), near the February consolidation lows.

Commodities (DBC) have consolidated above the pivot level at $23.6 (S2) and if support holds, we could be in for another leg up to $25.1.

Gold (GLD) has continued to rally unabated, above our final price target, now at $214. In the last 200 trading days (since June 2023), Gold has now taken the lead as the best performing asset class. This is happening even in the face of relatively high yields, as Central Bank demand has boosted the yellow metal up to 2.2 standard deviations above the regression line.

The price action of Gold is sitting in stark contrast to treasuries, the worst performing asset class in the last 200 trading days.

Speaking of which, TLT remains under selling pressure, as interest rate traders price in fewer rate cuts. Currently, only two cuts are expected, starting in September. A June rate cut has almost been fully priced out. Naturally, yields are rising and bonds sell off, especially at the long end.

Enterprise, our core investment strategy, has maintained its allocation this week, with very few modifications in the interim.

On Tuesday’s rebalance, SPY went from 64% in the previous week to 63% portfolio NAV today.

Bonds exposure (IEF) is decreased from 22.7% last week, to 15.64% today.

The position in GLD has been reopened, at a 4.82% allocation.

The position in DBC has also been reopened at a 2% allocation.

Cash went from 13.3% last week to 15.14% today, as risk is being decreased in our core model.

Since this model only trades 4 ETFs, we use it to judge overall portfolio positioning. The strategy’s risk profile is leaning defensive, using a significant allocation towards cash.

2. Sector / Industry Selection

The next step in creating our portfolio positioning is to break down each broad asset class into more granular groups of assets. This will help us understand which pocket of the market is outperforming or underperforming and make our selection accordingly.

Since Equities are an investible asset class, we’ll take a look at how different Factors are performing and check for any notable opportunities.

We have included tables for this week and the prior 3 article editions in order to help you compare developments (click on the arrows or thumbnails to cycle through the tables).

More factors are joining the negative M-Trend group this week. Previously, only the Nasdaq (QQQ) and the Dow Jones Industrial Average (DIA) were trending negative, but now 4 more factors have turned south as well (MTUM, IVW, IVE, IWM).

All factors are now within normal deviations in the short term, while only the Momentum Factor ETF (MTUM) and Growth Stocks (IVW) are experiencing a larger deviation in the longer term.

Among more granular Factor Returns, a sudden surge has occurred in companies with strong share buyback programmes. These have risen to the top of the leaderboard in the past 2 weeks.

Ranking shown for Share Buyback / FCF

On longer timeframes, R&D / Revenue (formerly a factor more commonly associated with short-term returns) is now becoming associated with high performance even at the 1-year horizon.

Ranking shown for R&D / Revenue

Across all timeframes, there is no remarkable factor that stands out at the moment.

Here’s how we stand on the Sectors front:

We have included 3 former tables from previous articles, for your convenience.

Similar to the disposition on the Factors side, more Sectors are now turning to a negative medium term trend. This degradation of momentum is certainly not surprising and confirms our belief that the market is puttin in a technical top. The gradual turn in medium term trends is an illustration that “tops are processes”.

In the short term, Basic Materials (XLB) and Energy (XLE) are boosted by commodity prices and have reached high deviations. Utilities (XLU) are similarly overbought. Longer term, only Financials (XLF) and Basic Materials (XLB) are overbought, while all of the other sectors are trading within normal ranges.

Tech (XLK) is surprisingly neutral, while Real Estate (XLRE) offers an interesting setup (one that Nostromo also caught). XLRE is a relative outperformer trading at reasonable deviations to its short term moving averages.

“C’mon… do something…” That’s the overall vibe of this system at the moment, as low volatility has all but ensured no trade signals are being triggered. This might change in the near future, as the market gets more volatile.

Meanwhile, Nostromo, our tactical allocation model, is only holding treasuries, via TLT, same as last week (and last month).

It will allocate towards XLRE on the next available BUY signal. It is also looking to swap TLT for TIP and HYG, on the appropriate

For more info about how Nostromo targets sectors or factors within a broader asset class, read this article. The first part sheds some light on the selection process going on in the background.

While underperforming in real life, this quirky model has its uses as a decision support tool. There is a clear case to be made here that equities are overbought and due for a correction. Nostromo is the only strategy to have almost zero drawdown during the Covid-19 crash in 2020, owing to its “unconventional” decision making style.

3. Individual Stock Selection

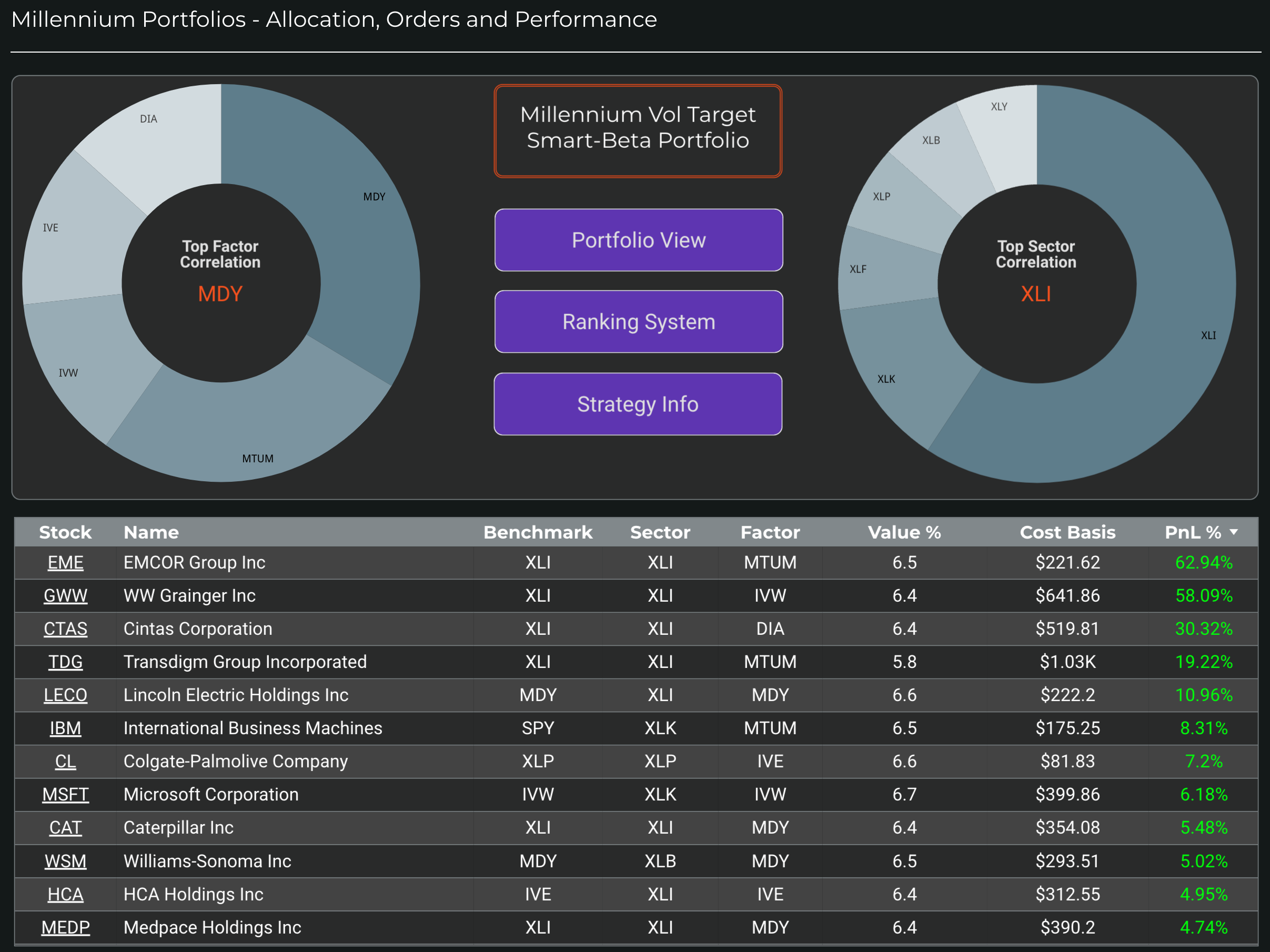

We’re seeing Millennium portfolios come under a bit of pressure this week, as the market turns down. Our portfolios have performed weekly rebalancing routines, and Vol Target would be our flavor of choice going forward, as it contains less volatile names.

As per usual, you can tweak this system using your own inputs if you wish.

4. Market Environment

The next step in our process is to take into account the type of market environment that we are currently trading in. For these purposes we use the Market Internals and the Market Fundamentals Instruments. Comments on the overall state of the market can usually be found in our Weekly Preview Article.

The divergence between SPY and the broad market still exists, but not to the same extent as in previous weeks. At the moment, there’s little else to learn from this indicator, as we’re not seeing a deterioration in the broad market just yet.

Neutral Signal in Stocks trading above their 200-day Moving Averages

As a contrarian indicator, sentiment works best near extremes. Right now, the reading is 61 / 100, still a far way from the “Sell Zone”. But we are farther still from the “Buy Zone” as well, so patience is required.

Neutral Signal in Sentiment

The comparison of Z-Scores reveals the disparity between large cap performance (SPY) and the top 1000 stocks by dollar volume (the broad market), equally weighted.

Resilience in the broad market means that the most heavily weighted names remain prone to profit taking. The chart below is very illustrative, as it shows how SPY loses momentum, while the broad market maintains it. The Z-Score divergence continues to compress and trend toward the neutral line. A word of warning, however - if a further correction is caused by a spike in yields, small and mid cap stocks will correct disproportionately, as they are more economically vulnerable.

Neutral Signal in Market Internals Z-Score

Dollar Transaction Volume is showing a lack of demand for stocks at the moment. Liquidity levels are not so low as to become problematic just yet. A spike in volume on lower prices would not be welcome either, as higher volume on lower prices is bearish.

Neutral Signal in Dollar Transaction Volume

5. Trading in the Sigma Portfolio (Live)

After reviewing all of the above factors, it’s time to decide on the actual investing strategy for our real-life portfolio.

With the major technical development of the week being a yet unconfirmed break of the 20-DMA for SPY, we’ve already reduced equity exposure yesterday. All other major factors are reading “neutral” at the moment so it’s time for us to sit tight, cut undue exposure where needed (take profits, stop out losing positions) and wait for a better opportunity to deploy capital.

We’re already at far more defensive levels in real life than our automated models suggest.

Automated Strategies and Market Outlooks

The Sigma Portfolio (Live)

For now, we are almost content with our positioning. The sole adjustment of the day will be the close of our position in Foreign Developed Markets ETF (EFA), on account of a stop-level violation.

We are executing the following orders at today’s close:

SELL 100% EFA (Close Position)

Following the execution of this order, here’s how the asset allocation will look like in the Sigma Portfolio:

We are getting overweight cash and tilting the portfolio to the defensive side. For now, there is no need to reduce exposure more than this, as we are sufficiently hedged. 29% cash is plenty of dry powder to deploy later this year.

Click here to access our own tracker for the Sigma Portfolio and understand how the positions contribute to the overall exposure profile. De-risking the portfolio has deflated both the win and the loss figures.

In total, we stand to gain $11.575 by risking $6.550 if our targets are correct. The risk-reward ratio is getting better, nearing our preferred 2-1 (for each dollar in risk, we stand to make 2 in returns).

On the sectors side, correlations are also fine, overweighting recent winners, Financials (XLF). We may reduce this, if trouble hits small lenders, however.

If you have any questions, please contact us using your favorite channel. Have a great week everyone, and happy investing!

Andrei Sota